Towards Zero Carbon Steel: How Hydrogen and Renewables Can Transform the Industry

The iron and steel industry is one of the most challenging to decarbonise. A high‑impact pathway replaces carbon‑intensive reductants with hydrogen produced via electrolysis powered by renewable energy. Doing so cuts process emissions at the ironmaking stage, supports high‑purity output, and strengthens long‑term competitiveness. Barriers remain, cost, energy demand, infrastructure and metallurgy, requiring investment, innovation and enabling policy. This article outlines the main mitigation pathways (CDA, PI and CCU), explains the hydrogen‑based DRI → EAF route, sets out current benchmarks, highlights challenges and operating essentials, and spotlights momentum from leading industrial projects.

Steel’s Emissions Reality and Why It Must Change Now

Fossil inputs, coal, gas and around 1,400 TWh of electricity, still underpin global steelmaking. Producing one tonne of steel emits roughly two tonnes of CO₂, accounting for about 8% of global emissions. Global output reached 1.95 billion tonnes in 2021 and could approach ~2.19 billion tonnes by 2050 as demand converges. Today, about 22% of steel is made via DRI and scrap‑based EAF routes; this could rise to ~50% by 2050, driven by the shift to low‑carbon pathways.

The sector’s three headline routes are Carbon Direct Avoidance (CDA), Process Integration (PI) and Carbon Capture & Usage (CCU).

- CDA: Hydrogen‑based direct reduction (H₂‑DR), hydrogen plasma smelting reduction (HPSR), molten oxide electrolysis (MOE), alkaline iron electrolysis (AIE).

- PI: Gas injection into the blast furnace, iron bath reactor smelting reduction (IBRSR), high‑quality steelmaking with increased scrap, substitution of fossil energy carriers by biomass.

- CCU: Converting captured carbon oxides into useful products, closing loops and reducing net emissions.

From Carbon to Hydrogen: The Chemistry That Changes the Outcome

In the conventional blast furnace route, coke reduces iron oxides to hot metal and generates large volumes of CO₂. Hydrogen can replace carbon monoxide as the reductant so that water vapour becomes the by‑product, dramatically lowering process emissions when hydrogen and electricity are renewable.

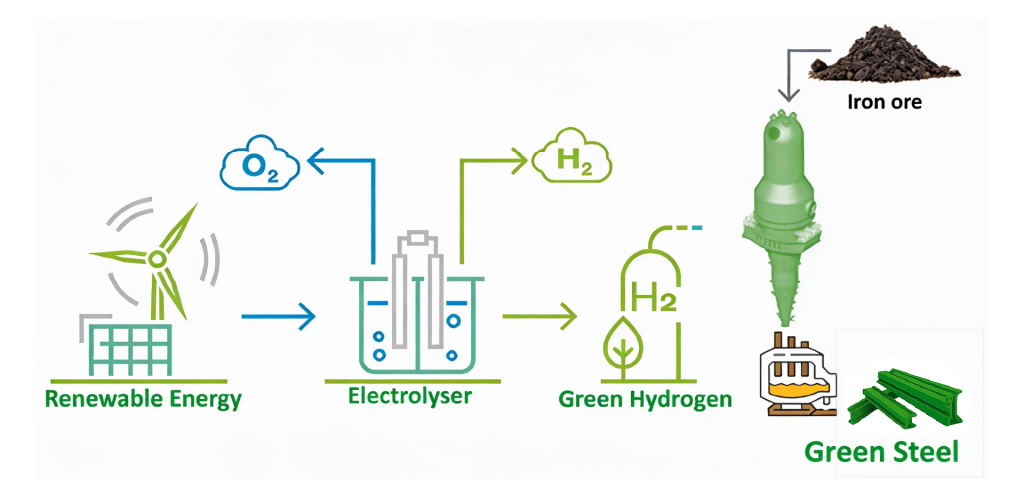

Hydrogen‑Based Green Steel Process Flow

Renewable electricity → Electrolyser → Green H₂ → DRI shaft furnace → EAF → Finished steel.

Conventional (coke‑based) reduction

3C + 2Fe2O3 → 4Fe + 3CO2

Hydrogen‑based reduction

Fe2O3 + 3H2 → 2Fe + 3H2O

FeO + H2 → Fe + H2O

With green hydrogen and renewable power end‑to‑end, direct emissions can fall by roughly 90–95% at the ironmaking stage, while maintaining high product quality.

Inside a Hydrogen‑Ready Plant: DRI, EAF and the Power of Renewables

- Hydrogen Reduction (DRI). Iron ore pellets are reduced in a shaft furnace using hydrogen, producing water vapour rather than CO₂.

- Electric Arc Furnace (EAF). Reduced iron and scrap are melted using electricity—ideally renewable—to produce high‑quality steel.

- Electrolysis for Green Hydrogen. Water is split into hydrogen and oxygen using renewable electricity.

- CCS for Blue Hydrogen. Where hydrogen is produced from natural gas, carbon capture and storage can limit emissions as a transitional step.

- Advanced Control Systems. Automation and sensors improve energy efficiency, process stability and safety in hydrogen‑rich environments.

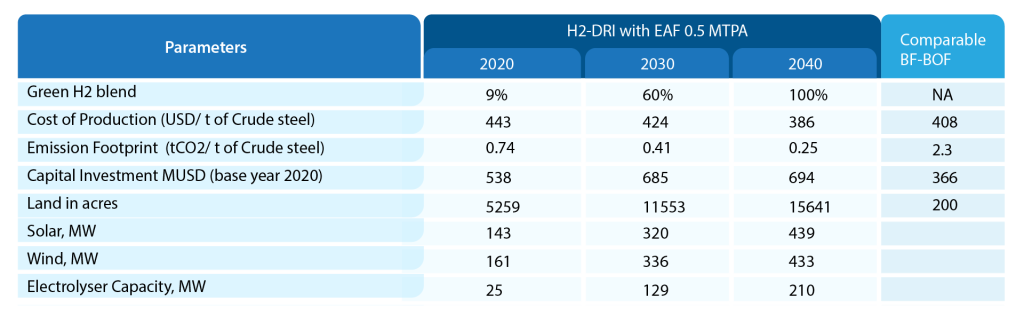

Performance and Design Benchmarks

Reference plants already in operation:

- Baosteel Zhanjiang (China) — Energiron Zero Reformer; natural gas, coke oven gas and hydrogen.

- voestalpine Texas LLC (USA) — 2 MTPA Midrex.

- Lebedinskiy GOK III (Russia) — 1.8 MTPA Midrex.

What Improves and What’s Hard: Benefits and Real‑World Constraints

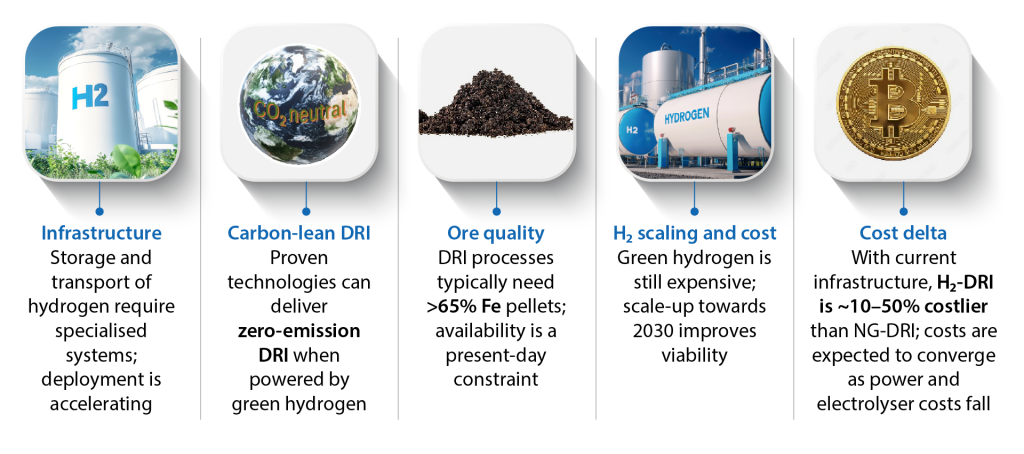

- Benefits: Deep reductions in greenhouse gases; renewable‑backed production systems; new economic opportunities in hydrogen and advanced steelmaking.

- Constraints: High cost of green hydrogen, significant energy requirements, infrastructure for production/storage/transport, high‑grade ore (>65% Fe) availability, metallurgical control (e.g., embrittlement), and the need for enabling regulation and supportive markets.

Hydrogen DRI Enablers and Challenges

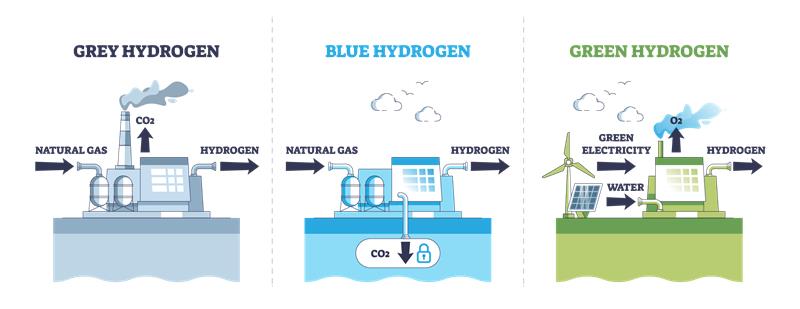

How Hydrogen Is Made: Grey, Blue and Green Pathways

Hydrogen for steel can come from different upstream routes with different carbon footprints.

Hydrogen Types (Grey vs Blue vs Green)]

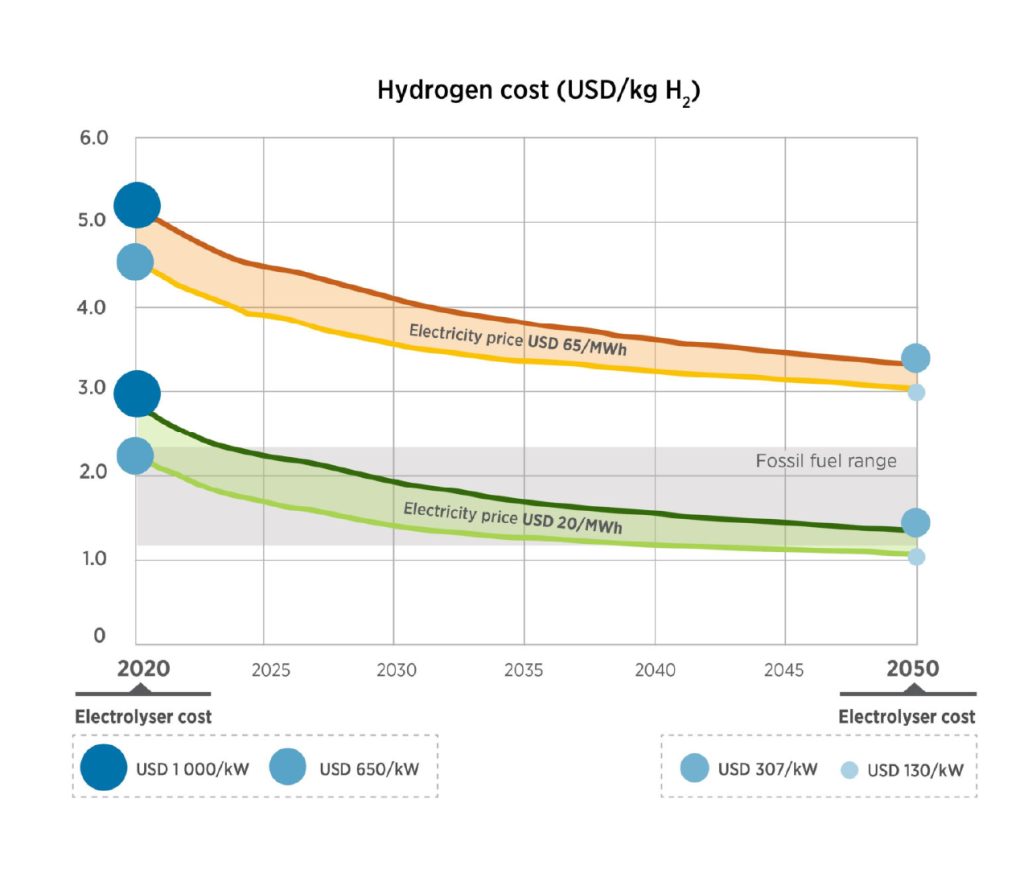

Projected Green Hydrogen Cost Reduction

Cost trajectory driven by falling renewable electricity prices and electrolyser capex; convergence is expected as scale and utilisation rise.

Source: IRENA‑derived trend

What It Takes to Run a Hydrogen‑Ready Operation Safely and Efficiently

- Hydrogen infrastructure. On‑site electrolysers or pipeline supply, compression and buffer storage, and safety‑led distribution networks.

- Hydrogen injection. Proven options for blast furnaces and shaft furnaces can reduce CO₂ quickly without compromising metallurgical quality.

- Process adaptation. Converters, ladles and handling systems must be engineered for hydrogen‑rich atmospheres, with robust safety protocols.

- Renewable integration. Solar, wind and hydro should power electrolysis and EAFs to maximise abatement and stabilise operating costs.

- CCU with hydrogen. Capturing and converting residual CO₂ streams helps legacy assets progress towards neutrality.

- Supply‑chain orchestration. Coordinated partnerships among green hydrogen producers, OEMs/EPCs and high‑grade ore suppliers are essential.

Momentum Signals from Industry: Sweden and Belgium Lead the Way

- Stegra (formerly H2 Green Steel), Sweden. Europe’s first commercial, fully integrated green steel facility is under construction. It combines hydrogen production, DRI, EAFs and finishing lines, underpinned by more than 1.5 million tonnes of off‑take from 2025. The plant is designed for carbon‑neutral operations from inception and demonstrates that hydrogen‑based steel is both technically and commercially viable at scale.

- ArcelorMittal Gent, Belgium. ArcelorMittal is advancing a multi‑year carbon‑capture pilot with Mitsubishi Heavy Industries’ KM CDR Process™ to deliver high‑purity CO₂ and partnering with D‑CRBN to plasma‑convert CO₂ to CO for reuse in steel and chemical production. A dedicated pipeline links the capture units to validate gas purity and integration—illustrating how hydrogen pathways and circular‑carbon solutions can work in tandem at complex legacy sites.

What to Expect Through 2030–2040: A Clearer Path from Pilots to Scale

- Hydrogen as the principal reductant across new DRI assets, with broader use of scrap‑EAF.

- Rapid growth of renewable capacity dedicated to hydrogen production.

- Electrolyser efficiency gains and cost declines, improving hydrogen availability and economics.

- Wider adoption of CCUS/CCU at integrated sites that cannot switch immediately.

- Premium markets for certified low‑carbon steel with robust traceability.

- Deeper collaboration across energy, mining, technology and steel to secure ore quality and resilient supply chains.

Conclusion — The Case for Accelerating Hydrogen‑Based Steelmaking

Hydrogen‑based steelmaking offers a practical, high‑impact route to decarbonise a sector central to global development. While cost, energy and infrastructure challenges remain, the combination of renewable hydrogen, DRI → EAF, CCU/CCS where needed, and strong supply‑chain partnerships can deliver decisive emissions cuts. With credible pilots, early commercial plants and rapidly improving economics, the path from pilot to scale is now clear—placing green steel at the heart of a climate‑aligned, competitive industrial future.